FINANCIAL INFORMATION -

Recent year-

FINANCIAL INFORMATION -

How We Assess

If the board of directors determines that additional funds are needed in any of the three accounts, it will make assessments as necessary. The association, in determining the proportionate amount to be paid by individual insurers, will take into consideration the lines of business written by the impaired insurer.

The Association shall assess individual insurers in proportion to the ratio that the total net direct written premium collected by the insurer bears to the total net direct written premium collected by all insurers in Texas for each line of business. The association shall determine the assessable premiums of an individual insurer and for all insurers in the state from the insurers' annual statements for the year preceding assessment. For the Workers Compensation Account, net direct written premiums include the “modified” annual premiums before the application of a deductible premium credit less return premiums and dividends paid.

Assessments for each calendar year may be made up to, but not in excess of, two percent of each insurer's net direct written premium for the preceding calendar year in the lines of business for which the assessments are being made. In the event of a natural disaster or other catastrophic event, the association may apply to the governor for authority to assess each member insurer that writes insurance coverage other than motor vehicle or workers' compensation (other lines), an additional amount not to exceed two percent of the insurer's net direct written premiums for the preceding calendar year.

If the maximum assessment in any calendar year does not provide an amount sufficient for payment of covered claims of impaired insurers, assessments may be made in the next and successive calendar years. For purposes of administration, the assessment is divided into worker's compensation insurance account, automobile insurance account and other lines insurance account.

Premium Tax Offset

One hundred percent of any assessment paid by an insurer shall be allowed to that insurer as a credit against its premium tax. The tax credit shall be allowed at a rate of 10 percent per year for 10 successive years following the date of assessment and, at the option of the insurer, may be taken over an additional number of years. The balance of any tax credit not claimed in a particular year may be reflected in the books and records of the insurer as an admitted asset of the insurer.

Available credit against premium tax may be transferred or assigned among or between insurers if:

(1) a merger, acquisition, or total assumption of reinsurance among or between the insurers occurs; or

(2) the commissioner by order approves the transfer or assignment

Maximum Assessments

The maximum assessment that the Association can assess each calendar year is 2%. For example, if your company has Auto premiums of $240,000 for calendar year 2021, the maximum assessment that can be levied on your company for 2022 would be $240,000 x .02 = $4,800. The only variation in the maximum possible assessment is in the other lines business where if there is a catastrophic disaster, the Association may apply to the Governor of the State of Texas for an additional 2% assessment, pursuant to the manner prescribed by the Association’s Plan of Operation.

Current Premium Amounts (Calendar Year 2023)

For any Assessments levied in 2024

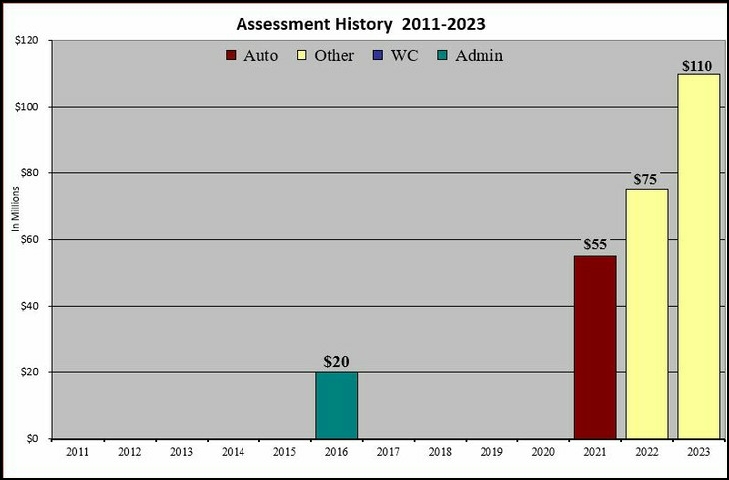

Assessment History

The graph below shows that TPCIGA issued the first assessment in ten years in 2016. There was an other lines assesment each of the last two years.

Early Access

Early Access generally refers to distributions of funds from the receivership estate to guaranty funds during the course of a receivership. The graph below indicates that over half of the Association's funding came from estate distributions. When early access distributions are received during the course of the receivership, which may take several years to complete, the need for assessments diminishes. Early access distributions provide needed funds to pay claims during the life of the estate and allow the Association to earn investment income from the distributions as the estate progresses.

Auto

Other Lines

Workers’ Compensation

$38,383,798,973

$34,434,391,188

$2,960,157,190

Information on this site is not legal advice and is not intended to be a comprehensive statement of the law or of the TPCIGA's policies and procedures. References to the laws of any jurisdiction are for informational purposes only and are not a substitute for the official version of a statute. TPCIGA makes no warranty as to the accuracy or reliability of the content of this website or other related websites.

© Texas Property and Casualty Insurance Guaranty Association